Housing Market Indicators

Introduction

The health of the housing market can be an important indicator of the performance of the whole economy.

As a general rule, a buoyant economy will have a strong housing market, and the reverse can also be true. Changes to the housing market in the US became a major factor in the global financial crisis of 2008.

In the US, a long list of housing numbers is released throughout each month. All have a part to play in painting a picture of how healthy the housing market is, but some are more important than others.

The leading housing indicators to watch are:

- Case Shiller Home Price Index

- Building Permits and Home Starts

- Existing-Home Sales

- New Home Sales

- Pending Home Sales

With so much data on the US housing market released every month, you may find it easier to select a few key signals.

Building Permits, New Home Sales, and the Case Shiller HPI

One approach is to focus attention on three elements:

- The trend in future house building

- The sale of a newly finished house

- How house prices are performing

This information is contained within the data for Building Permits, New Home Sales, and the Case Shiller HPI.

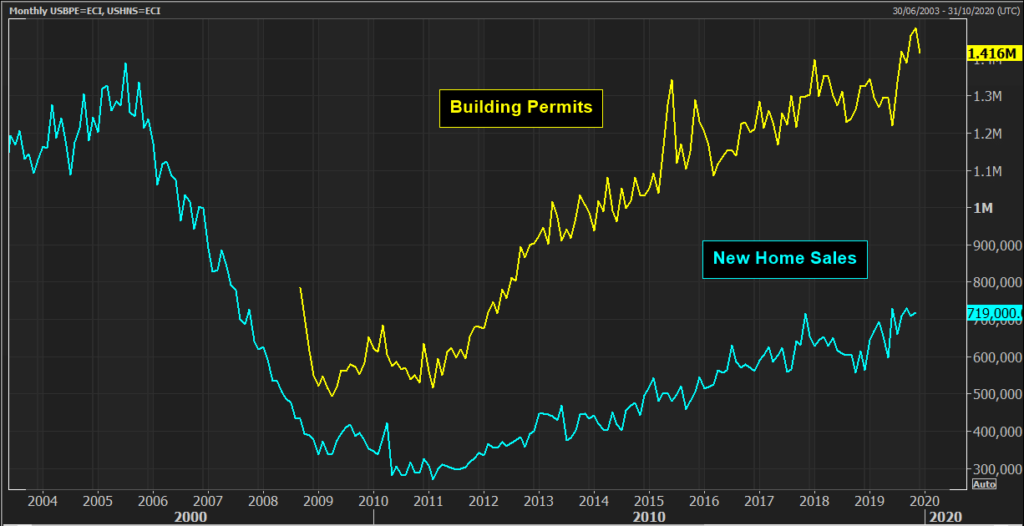

Building Permits measure the change n number of new building permits that have been issued by the US Government. Historically around 1.5m new homes are needed every year in the US due to population increases, immigration and loss of housing stock due to disrepair. A more significant number of Building Permits will drive future home building and the associated economic benefits.

New Home Sales tend to have a greater impact on GDP than other indicators such as Existing Home Sales. New Home Sales may account for only 10 per cent of all sales. Still, the spending that takes place when constructing a new home rather than selling an existing home (which is effectively just a transfer of title deeds) is much higher.

The new housing market makes up ca. 5% of GDP. Furthermore, the addition of all the purchases people make when moving into a new home (furniture, appliances and electronics) mean that New Home Sales can have a sizeable impact on GDP.

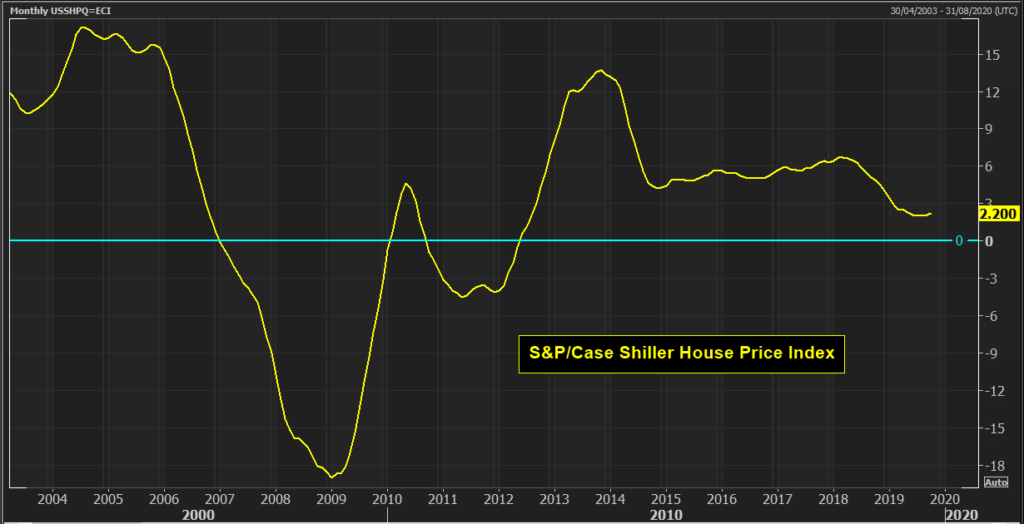

The S&P/Case-Shiller, Home Price Index, measures US residential real estate prices, tracking changes in the top 20 metropolitan regions. The value represents the following year-over-year percentage change in the home prices index, as of the last month-end.

Rising value levels indicate an improving economy and increased homeowner wealth. Declines in the value usually indicate the opposite.

The impact of housing data on markets

Even though housing data isn’t considered “tier one” data, it will still have an impact on US treasuries, the dollar and equities (though to a lesser extent).

Stronger housing indicators will:

- Be positive for risk appetite and positive for the US economy.

- Pull yields higher, helping to strengthen the outlook for the dollar.

- Affect equities – though the impact may be more targeted, with housing stocks and consumer-focused stocks benefitting first.